philadelphia property tax rate calculator

The citys current property tax rate is 13998 percent. Property taxes are one of the oldest forms of taxation.

Pin On Personal Financial Budgeting

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

. It also provides for an easier to understand tax system by removing complicated fractions when. The new rates are as follows. To get started you can.

The City calculates your taxes using this property tax rate. City of Philadelphia. The Office of Property Assessment OPA determines the value of the property on which the taxes must be paid.

With market values recorded Philadelphia together with other in-county public districts will calculate tax levies separately. Get a property tax abatement. In the state of California the new Wage Tax rate is 38398 percent.

The median property tax on a 13520000 house is 123032 in Philadelphia County. In the US property taxes predate even income taxes. Set up a Real Estate Tax payment plan for property you dont live in.

What Are Property Taxes. Set up Real Estate Tax installment plan. How is PA transfer tax calculated.

Set up a Water bill payment plan. Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Get Real Estate Tax relief.

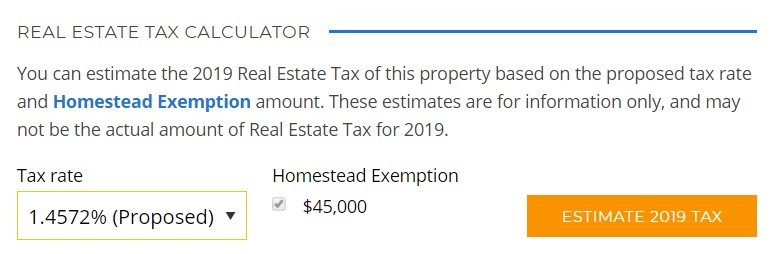

Currently the Philadelphia property tax rate is 13998. If you think your new home assessment is too high. PHILADELPHIA City officials today unveiled a web-based calculator that will allow property owners to see how changes in assessments and the Mayors Fiscal Year 2019 education funding proposal would affect their property tax bills for next year including the effect of proposed revisions to the Homestead Exemption.

Select a location on the map. Consider the transfer tax sometimes known as a tax stamp to be a type of sales tax on real estate. Pennsylvania has the sixth highest average property tax rate among all 50 states according to the Tax Foundation.

The state of Pennsylvania charges one percent of the sales price while the municipality and school district each charge one percent of the sales price for a total of two percent ie. Pennsylvania is ranked 1120th of the 3143 counties in the United States in order of the median amount of property taxes collected. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax.

The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Heres a basic formula. Real Estate Tax bills are sent in December for the.

Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax. Report a change to lot lines for your property taxes. The City and the School District of Philadelphia impose a tax on all real estate in the City pursuant to Philadelphia Code Chapter 19-1300 as authorized by 72 PS.

For the home in Fairmount listed above with a market value of 528500 the. What is the local tax rate for Philadelphia. This can get confusing so heres an example.

Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax. The fiscal year 2020 budget does not contain any changes to the tax rate so the same tax rate as 2019 will be used to calculate next years tax bills. If Philadelphia property taxes have been too high for your budget causing delinquent property tax payments.

The median property tax on a 13520000 house is 141960 in the United States. Hawaii has the lowest average property tax rate in the country at a rate of just 034. Please note that the calculator below only provides an estimate.

Furthermore the rate of Earnings Tax for. Look up your property tax balance. Lets say you have a home with an assessed value of 80000.

There are three vital stages in taxing real estate ie devising tax rates estimating property market values and collecting receipts. To get an estimate of your annual property tax bill you can use a regular calculator to determine 13998 the citys current real estate tax rate of your current assessed value. The tax rate and the value of tax-relief programs such as the homestead exemption for owner-occupied homes could change before City Council finalizes a new.

Can anyone give me a rundown of. If your assessed value went up your property taxes will too. The median property tax on a 13520000 house is 182520 in Pennsylvania.

Get the Homestead Exemption. Then receipts are distributed to these taxing authorities according to a predetermined plan. Enroll in the Real Estate Tax deferral program.

In fact the earliest known record of property taxes dates back to the 6th century BC. Typically the owner of a property must pay the real estate taxes. The City calculates your taxes using these numbers but can change both the Homestead Exemption amount and the tax rate.

2 percent X 100000. However anyone who has an interest in a property such as someone living in the property should make sure the real estate taxes are being paid. Taxing districts include Philadelphia county governments and various special districts such as public hospitals.

If you receive a property tax abatement are enrolled in LOOP have received. The total transfer tax rate in Pittsburgh is 5 while the transfer tax rate in Philadelphia is 4278. You can use this application to estimate your real estate tax under the Actual Value Initiative AVI.

If you receive a property tax abatement are enrolled in LOOP or. The current rates for the Realty Transfer Tax are. It frees the first 25000 of the homes assessed value from all property taxes and it exempts another 25000 from non-school property taxes.

Voluntary disclosure of non-payment. Use the property tax calculator to estimate your real estate taxes. Philadelphia released new assessments of property values which they will use to calculate 2023 property tax bills.

When it comes to property taxes our neighbor New Jersey takes the top rank with a state average of 228 percent the most in the country. Based on the current tax rate for every 10000 in increased value your yearly tax bill will go up by 140. Submit an Offer in Compromise to resolve your delinquent business taxes.

The Actual Value Initiative or AVI is a program for re-evaluating all properties in the city to ensure that values are fair and accurate. You can also generate address listings near a property or within an area of interest. Property tax bill assigned market value x 013998.

The first 25000 would be exempt from all property taxes. Active Duty Tax Credit. Set up a payment agreement for your business or income taxes.

Please note that the tool below only provides an estimate. Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. This calculator can only provide you with a rough estimate of your tax liabilities based on.

In the future the City may change the Homestead Exemption amount or the tax rate. A composite rate will generate anticipated total tax revenues and also produce your assessment total. Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000.

Property Tax Calculator Rock Commercial Real Estate

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

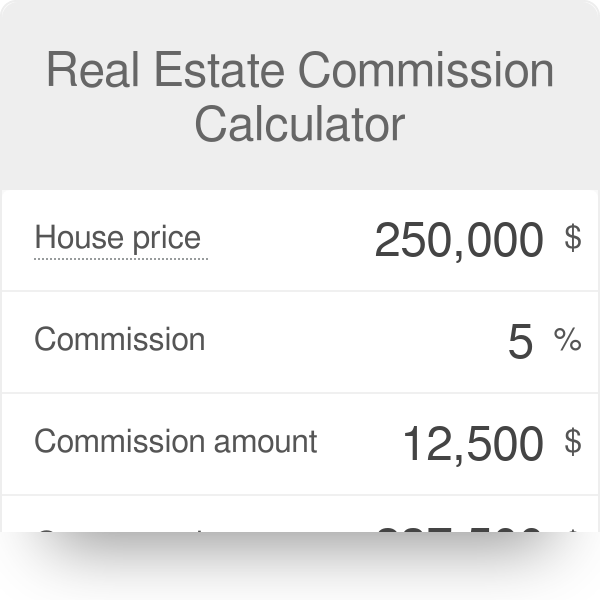

Real Estate Commission Calculator

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Financial Criteria For Legal Residency In Mexico 2022

Property Tax Calculator Casaplorer

District Of Columbia Property Tax Calculator Smartasset

How Appraisers Determine The Value Of Snellville Properties Buying Property Georgia Properties Hvac System

Accounting Firms In Montgomery County Tax Services Accounting Firms Montgomery County

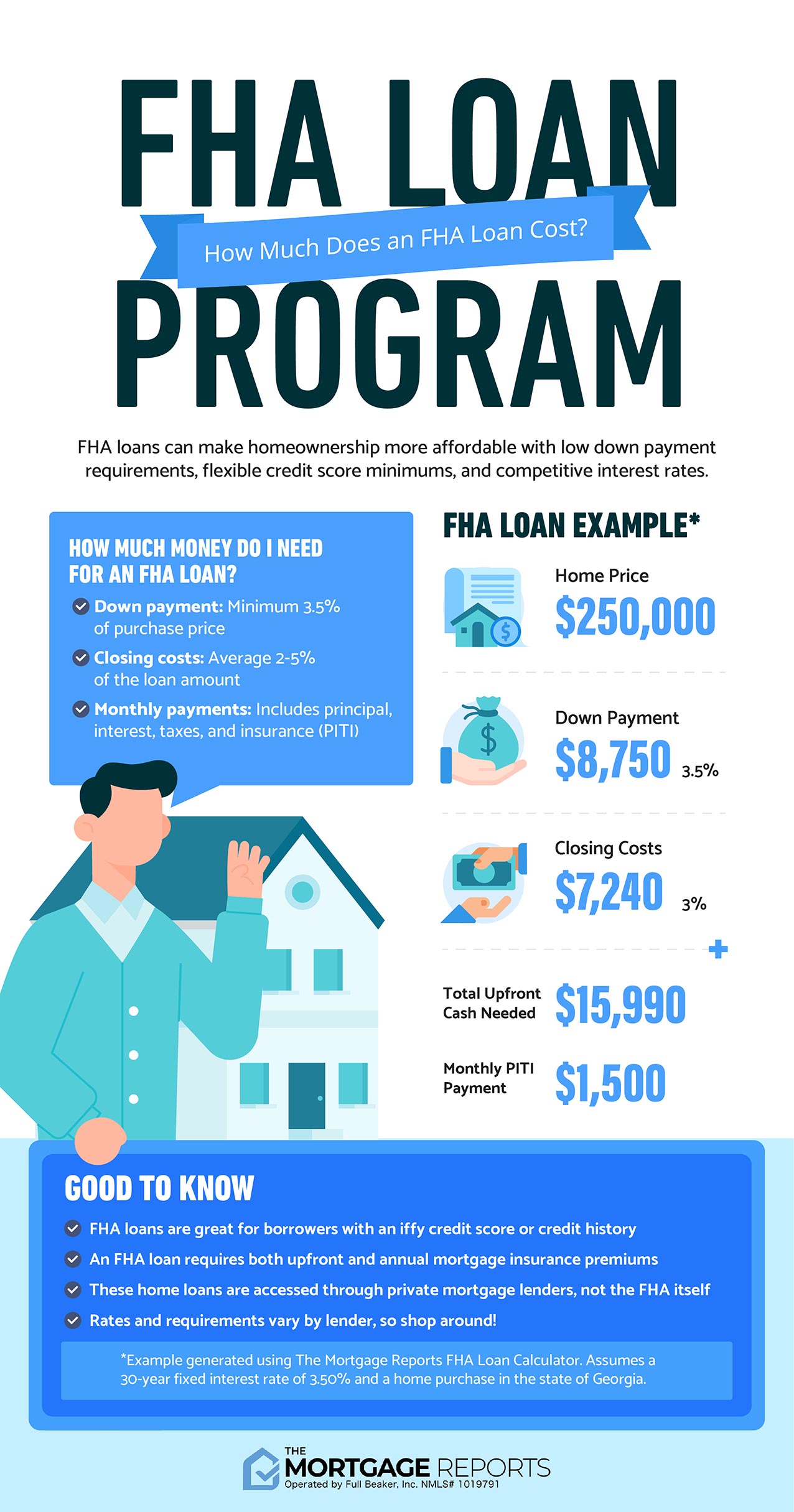

Fha Loan Calculator Check Your Fha Mortgage Payment

Pennsylvania Property Tax Calculator Smartasset

6 Myths About Short Sales We Buy Houses Selling House Real Estate

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

Another Successful Transaction This Is How It Works I M A Worker At Moneygram And I Can Access And Add Funds When People Make Their Transaction How Do You I

Property Tax Calculator Rock Commercial Real Estate

Philadelphia County Pa Property Tax Search And Records Propertyshark

Are You Paying Too Much Property Tax Property Tax Tax Home Ownership

Utah Protective Orders And Divorce Child Custody Family Law Attorney Attorneys

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia